In this article

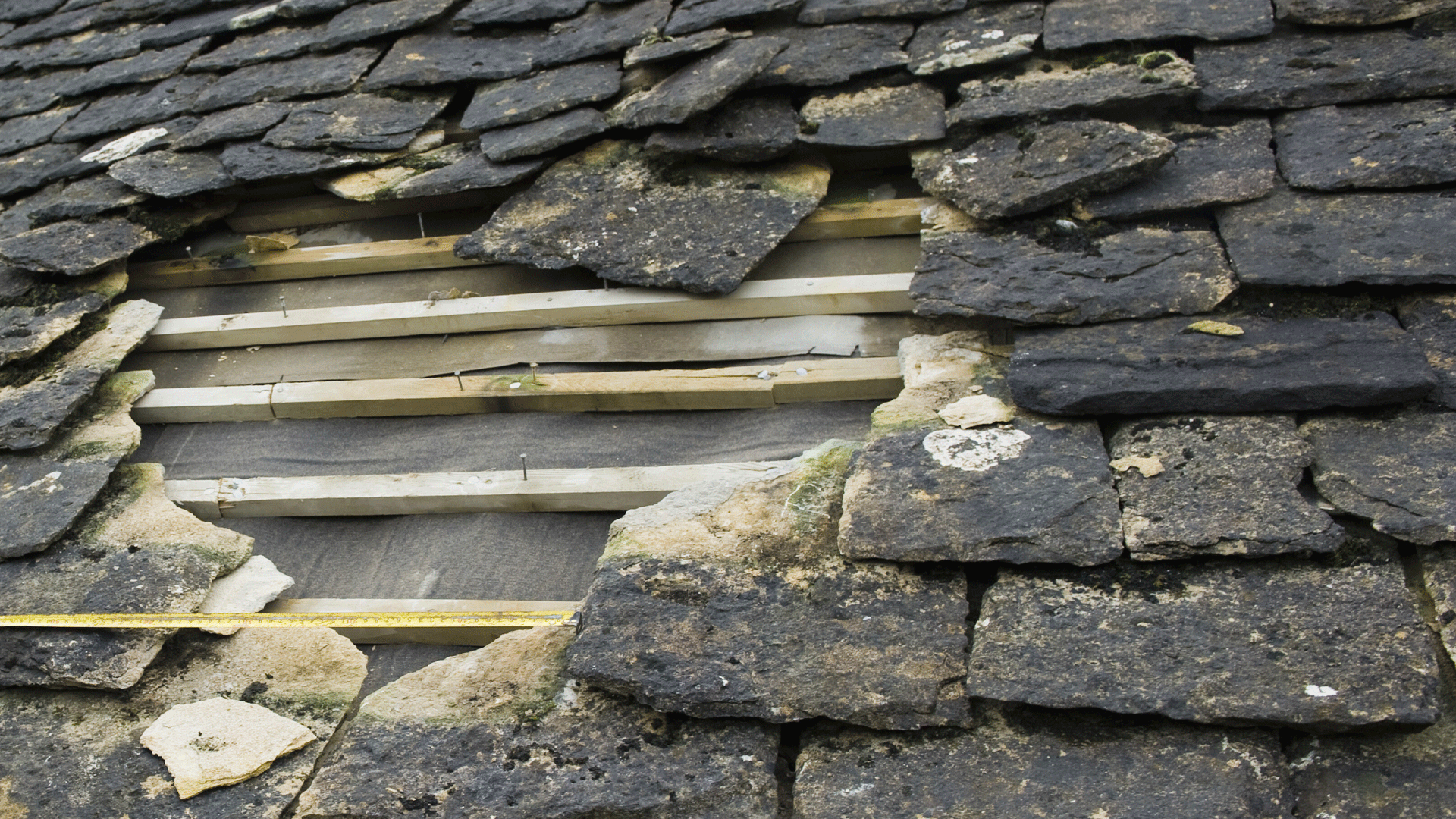

Purchasing an uninhabitable property can be an exciting yet challenging venture.

These properties often present unique opportunities for substantial returns on investment, especially if located in desirable areas or available at a significantly reduced price.

Securing finance for such properties can be more complex than obtaining a traditional mortgage. One effective solution to consider is a bridging loan.

What is a Bridging Loan?

Bridging loans are short-term financial products designed to ‘bridge’ the gap between the immediate need for funding and securing a long-term financing solution.

They are particularly useful for buyers looking to purchase uninhabitable properties that traditional mortgage lenders might deem unsuitable for lending.

This type of bridging finance can be a lifesaver for those needing quick property purchase solutions.

Bridging Loans

Explained in 57 seconds

Find more videos like this on MoneymanTV

Types of Bridging Loans

Regulated Bridging Loans

Regulated bridging loans are overseen by the Financial Conduct Authority (FCA) and are intended for residential properties where the borrower or an immediate family member will reside.

If you plan to renovate the property to make it habitable and then live in it, a regulated bridging loan might be suitable.

Unregulated Bridging Loans

Unregulated bridging loans are not governed by the FCA and are often used for commercial purposes, property investments, or buy to let properties.

If the property you are purchasing is intended for resale or rental after renovation, an unregulated bridging loan could be the appropriate choice.

Residential Bridging Loans

Residential bridging loans are specifically designed for residential properties. They can be either regulated or unregulated, depending on the intended use of the property.

Residential bridging loans are ideal for buyers who aim to make the property habitable quickly and either live in it or sell it.

Bridging Loans for Auction Properties

When purchasing properties at auction, the buyer typically needs to complete the purchase within 28 days. Bridging loans for auction properties can provide the necessary funds swiftly, allowing buyers to meet tight deadlines without hassle.

This makes them an excellent option for those involved in property development and seeking to quickly turn around their investment.

How to Secure a Bridging Loan

Evaluate Your Financial Position

Assess your current financial situation, including your ability to repay the loan.

Bridging loans often come with higher interest rates than traditional mortgages, so it’s crucial to ensure you can handle the repayments.

This involves understanding the bridging loan rates and how they compare to other short-term financing options.

Find a Reputable Lender

Research lenders who specialise in bridging loans. It is advisable to get the help of a bridging specialist who can guide you through the process.

Look for lenders with experience in financing uninhabitable properties and check their reviews and credentials.

A specialist can help you navigate the complex property market and find the best terms for your loan.

Prepare a Solid Plan

Lenders will want to see a detailed plan outlining your intentions for the property, including how you plan to make it habitable and your strategy for repaying the loan.

This plan should include a timeline, budget, and potential exit strategy, such as refinancing or selling the property. Having a well-thought-out property renovation plan can greatly enhance your chances of loan approval.

Valuation and Legal Work

The lender will require a professional valuation of the property and will conduct legal checks to ensure everything is in order.

This process can be faster than traditional mortgage applications but still requires thoroughness. Accurate property valuation is crucial in determining the loan amount and the viability of the investment.

Application Process

Complete the application process by providing all necessary documentation. This typically includes proof of income, details of the property, your renovation plans, and any other relevant financial information.

A well-prepared loan application can expedite the approval process and ensure you secure the necessary funds.

Speak to an Advisor – It’s Free!

Schedule a free callback from one of our experts today.

- All situations considered

- Transparent and honest mortgage advice

- We search 1000s of purchase and remortgage deals

Our customers rate us 4.9/5

Approval and Funds Release

Once approved, the lender will release the funds, allowing you to proceed with the property purchase and renovation.

With the funds in hand, you can begin your property development project and work towards making the property habitable.

Making the Most of Your Bridging Loan

Purchasing an uninhabitable property with the help of a bridging loan can be a smart move for savvy investors and homebuyers alike.

By understanding the different types of bridging loans, regulated, unregulated, residential, and those specifically for auction properties, you can choose the best financial product to suit your needs.

Always ensure you have a robust plan and work with reputable lenders to make your property investment a success.

If you have any questions or need further guidance on securing a bridging loan, feel free to speak to our team of bridging loan specialist, who are here to help you navigate the process smoothly.

Working with a bridging specialist can significantly ease the process and ensure you get the most suitable loan for your needs.