In this article

When considering a bridging loan, many potential borrowers often wonder about the necessity of a valuation.

Bridging loans, whether for buying a house, refurbishing a property, or securing funds for an auction property, typically require a valuation.

This process is essential for both the borrower and the lender, ensuring that the property’s value justifies the loan amount and mitigates potential risks.

Why is a Valuation Necessary for Bridging Loans?

A valuation provides an accurate assessment of the property’s current market value. Lenders rely on this information to determine the loan-to-value (LTV) ratio, which affects the amount of money they are willing to lend. For borrowers, a valuation ensures they are making a sound investment.

Bridging Loans for Auction Property

Quick turnaround times often necessitate fast valuations. The property is usually purchased ‘as is’, so a valuation helps determine the immediate worth, considering any required refurbishment.

Bridging loans for auction properties are particularly popular due to the speed at which funds can be released, enabling buyers to meet tight auction deadlines. A detailed valuation ensures that the investment is sound and aligns with the expected returns.

Bridging Loans for Over 50s

Tailored for older borrowers, these loans may still require valuations to assess the property’s value, ensuring the loan amount aligns with the equity available. Bridging loans for over 50s offers financial flexibility, allowing older homeowners to unlock property equity.

Valuations in this context are vital to ensure that the borrowing is safe and within the equity limits of the property, providing peace of mind for the borrower and lender alike.

Large Bridging Loans

Involving substantial sums, these loans invariably need thorough valuations to ensure the property’s value can secure the large amount borrowed.

Large bridging loans often fund significant investments or property purchases, where accurate valuations are crucial to justify the sizeable lending amounts.

These valuations help both parties understand the financial scope and viability of the loan, mitigating potential risks associated with high-value transactions.

Speak to an Advisor – It’s Free!

Schedule a free callback from one of our experts today.

- All situations considered

- Transparent and honest mortgage advice

- We search 1000s of purchase and remortgage deals

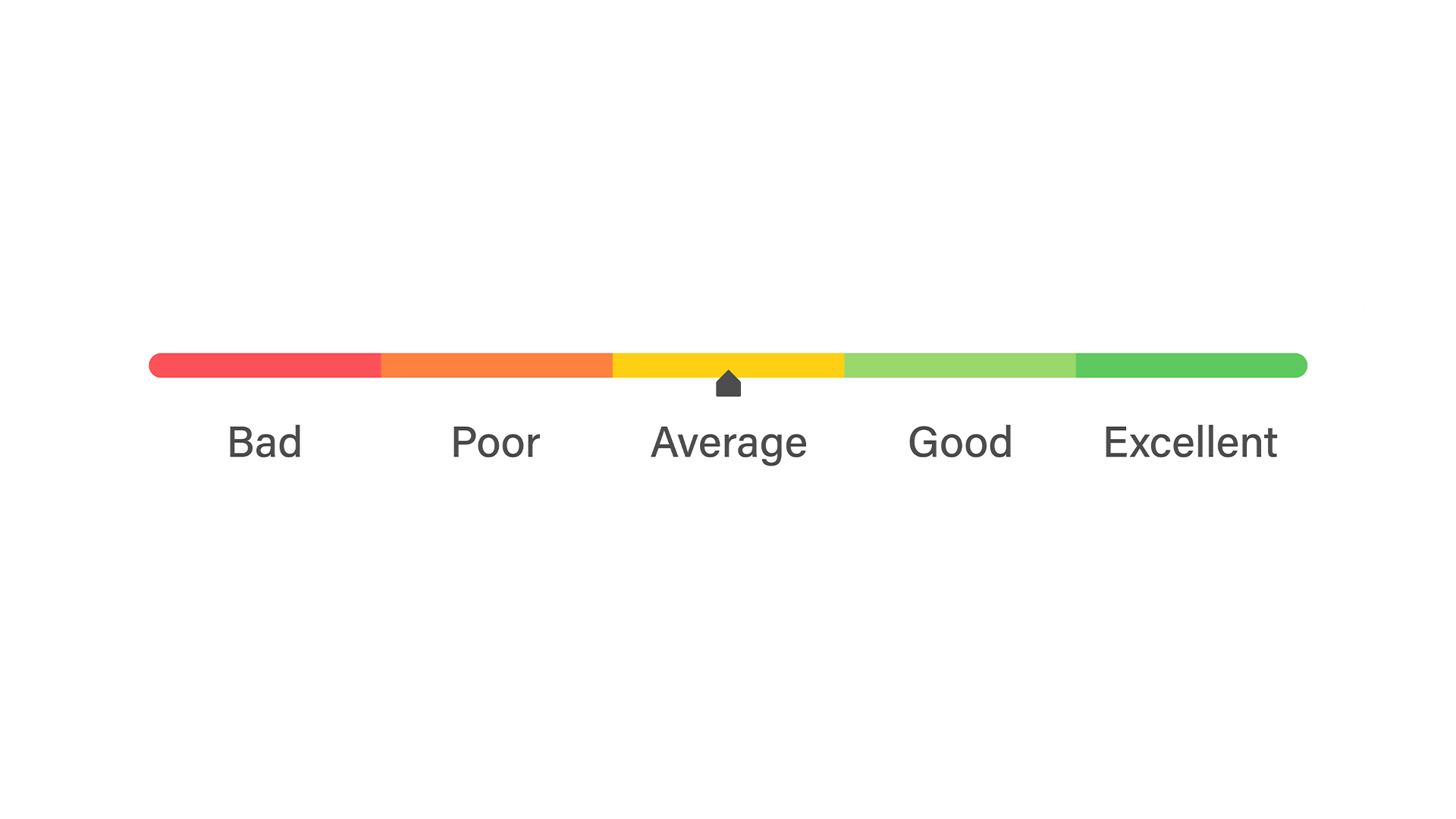

Our customers rate us 4.9/5

Regulated and Unregulated Bridging Loans

Regulated bridging loans, often for residential properties, require a detailed valuation for compliance purposes. This ensures the loan adheres to regulatory standards, protecting the borrower.

Conversely, unregulated bridging loans, used for certain types of properties, also benefit from valuations to determine the property’s market value. These valuations help assess the loan’s feasibility and align with the property’s prospects.

Second Charge Bridging Loans

These loans, secured against a property already mortgaged, need valuations to establish the equity available after considering the first charge.

Second-charge bridging loans allow borrowers to unlock additional funds without altering the first mortgage. A precise valuation is necessary to ensure there is sufficient equity to cover both the first and second charges, safeguarding the interests of all parties involved.

Refurbishment Bridging Loans

Used to fund property improvements, these loans require an initial valuation and a post-refurbishment valuation to determine the property’s enhanced value.

Refurbishment bridging loans provide essential funds for property upgrades, increasing the property’s market value. The initial valuation establishes the starting value, while the post-refurbishment valuation ensures that the improvements have added the anticipated value, justifying the investment.

Development Finance

Essential for large-scale projects, development finance requires an in-depth valuation of the land and proposed development to assess future value and risks.

These valuations are comprehensive, considering both the current state of the land and the potential value post-development. This assessment is critical for lenders and borrowers to understand the project’s financial viability and future profitability.

Residential Bridging Loans

Typically used to bridge the gap between buying a new home and selling the old one, residential bridging loans necessitate a valuation to confirm the property’s worth in the current market.

This type of loan helps homeowners secure a new property without waiting for the sale of their existing one. Accurate valuations ensure that the loan amount is proportionate to the property’s value, facilitating a smooth transition.

How Valuations Work

Valuations for bridging loans are conducted by professional surveyors who inspect the property and analyse market trends. They provide a detailed report, which includes:

- Current market value

- Potential future value (for development or refurbishment loans)

- Any factors that may affect the property’s value

Valuations are crucial to safeguarding both the borrower’s and the lender’s interests. They ensure the loan is proportionate to the property’s actual worth and potential resale value, thus minimising financial risk.

If you have any specific questions about your circumstances or need personalised advice, our team of mortgage advisors are here to help.

Speak to them today to explore your options and make informed decisions about your bridging loan needs.