We have access to 1000’s of both purchase and remortgage deals.

Working alongside your HR department, we will ensure that your employees are always on the best mortgage deal available to them. We have some great fin-tech software that helps us with this.

Also, for those employees with lower deposits and/or a lower credit score, we’re experienced, we have access to more specialist lenders.

Without a professional on your side, navigating around a search engine or price comparison site can be confusing. We will help your workforce, at all levels, through the maze of insurance policies and recommend the best ones for them.

Policies we can provide are life insurance, critical illness and also bespoke income protection to run alongside your employer sick pay scheme in the event of a long-term illness or injury.

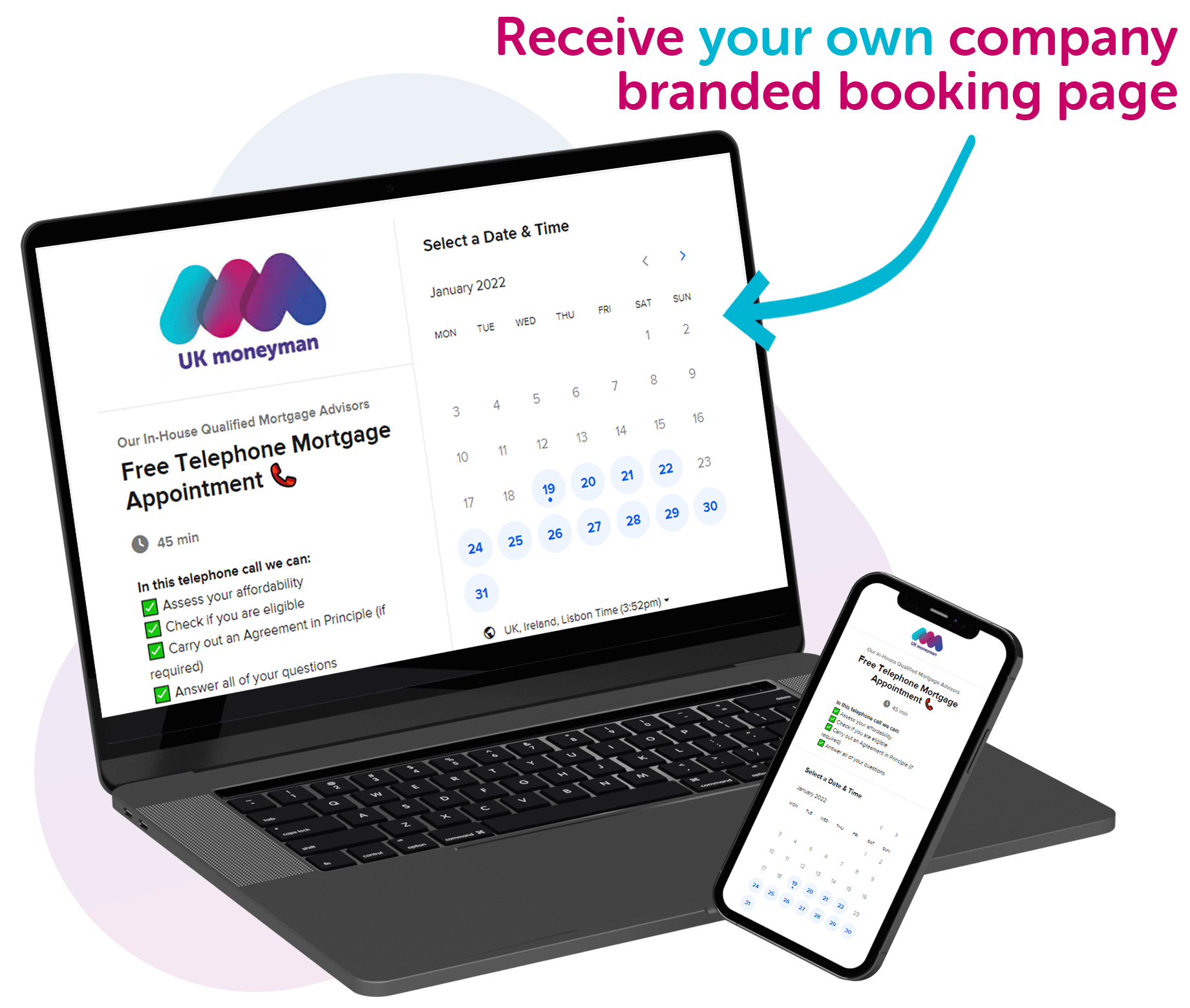

Book online with ease with our Calendly integration. Your employees can select either a video or a telephone call and select a convenient appointment time, including evenings and weekends. We’ll work around any family and work commitments.

Let us develop the financial education of your workforce, everything is made by us.

Our playlists include, how to get a mortgage, regular market updates, the different types of mortgages available, which insurance policy is right, improving your credit score, pay off a mortgage quickly, consolidating debts, using benefit income, saving for a deposit, separation and divorce and lots more!

If you are interested in our Introducer Referral Scheme, please feel free to contact us by filling out the contact form below.

Your employee will book a video or a telephone call online, via your unique booking link, and select a convenient time. They can invite a partner or family member to the appointment also during the process.

Once an appointment is booked, a text message will be received, confirming the date and time and a link to a short online form. This will take a couple of minutes to complete but will save time later down the line.

An appointment will take approximately 45 minutes and we’ll be able to answer any questions and let them know if you qualify for a mortgage.

We are open and honest to first time buyers looking to get on the property ladder for the first time. Usually, they have saved up a 5% deposit or have help towards this from a family member.

Alternatively, we are highly experienced in helping your staff move up the property ladder or to review their remortgage options.

We work with a large number of mortgage lenders, most of which will take bonuses, commissions, overtime, dividends, maternity pay, recent pay increases, benefit income etc into account along with salary.

No, there are no fees to the employer or employee.

UK Moneyman receives the standard procuration from the mortgage lender along with life commission if an insurance policy is taken out.

Our typical fee for mortgage advice ranges from £299 to £699, so this is a big saving for your employees.

To make the scheme successful for all parties, regular promotion on newsletters, internal communications and/or payslips works well.

Often, companies have schemes such as voucher and discount schemes in place. Usually, you’re able to add custom perks to your dashboard. We’ll be able to help you with this.

Yes sure, we have local contact with specialists in financial advice, pension advice, investment advice, inheritance tax planning and equity release/later life mortgages.

We’re flexible around your employee's work and family commitments.

With our various social channels, your employees will have access to a large catalogue of helpful guides and information.

As part of the process, your employee will have their own point of contact.

Free access to mortgage advice will allow your employees to explore and work towards improving their situation such as credit score and homeownership.

Getting a new mortgage or porting an existing mortgage isn’t always easy. We’ll be here for them throughout the whole process.

Our advisors will make sure that your employees have the correct insurance policies in place in order to protect them in the future.

It’s fee-free advice and at no cost to the employer. Also, we’ll always ensure everyone is on the best deal available to them.

There isn't a situation we haven't come across before, we fully understand all types of mortgages.

Our Customers Love Us

2000+ 5-Star Reviews

Derek

They were great when handling our mortgage application even though it was a bit different to the normal one. Highly recommended

3 days ago

Michelle

The team at UK Moneyman have been excellent, really informative, providing sound advice with no judgement and supporting the best possible way forward for myself. I would definitely use the team again, they’ve made the whole process simple and...

2 weeks ago

Lawrence

Great company to work with, very helpful and excellent communication. Chris and Jo did a great job with our application. I highly recommend.

2 weeks ago

Gemma

Excellent speedy service and always available to work around the best times for us, including calls at weekends

1 month ago

Gillian

Having dealt with Leo previously I knew I would be getting a brilliant service and a good deal.

1 month ago

Karen

Very helpful.Quick response to any questions or concerns. Selected the right product to meet our requirements.

1 month ago

Stephen

We went to the Moneyman to start with regarding a new mortgage only which went really smoothly and everything was explained in simple terms at our request Malcom made it feel at ease . Once i had the confidence with them we asked them to help with...

1 month ago