In this article

Get The Ball Rolling in 2025 With The Help of a Mortgage Advisor!

After an incredibly busy end to the year, we’re back to the start of a new chapter with the entire year ahead full of possibilities!

There’s plenty to keep an eye on in the property market:

🏡 New Build Push: The Government’s ambitious target of 1.5 million new homes is back on the agenda. While challenges like a shortage of tradespeople and affordability persist, it’s an encouraging step forward for future homeowners.

📉 Interest Rates Hold Steady: The Bank of England predicts inflation is easing and rates may not go up from where they are – great news for buyers if so! In fact, in many parts of the UK, it’s still cheaper to buy than rent if you can raise a deposit.

📅 Record Mortgage Renewals: 2025 is a big year for mortgage renewals. Whether you locked in a 5-year deal during the pandemic or opted for a shorter term after the mini-budget, we’re here to help you find the best deal for your circumstances.

🏘️ Buy-to-Let Trends: While the market has tightened, serious landlords are still active and making strategic moves. If you’re in the market or considering your options, we can guide you.

💷 Stamp Duty Deadline: Don’t forget – on 31st March, the nil-rate band for Stamp Duty will drop back to £300,000 for first-time buyers and £125,000 for others. This could make the first quarter a busy one for completions, so now’s the time to plan ahead!

If 2025 is the year you’ve been waiting for to buy your first home, move up the ladder, or secure a new deal, let’s start the conversation.

Whether you need advice, a fresh mortgage deal, or guidance through the process, we’re here to make your journey as smooth as possible.

📞 Get in touch today to discuss your mortgage options – we’d be delighted to help you make the most of this exciting year!

Speak to an Advisor – It’s Free!

Schedule a free callback from one of our experts today.

- All situations considered

- Transparent and honest mortgage advice

- We search 1000s of purchase and remortgage deals

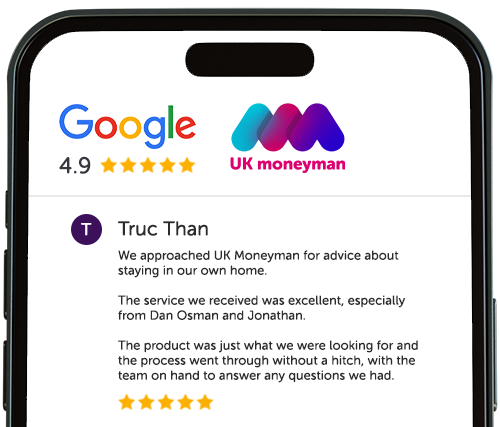

Our customers rate us 4.9/5

⏳ Is Your Mortgage Deal Ending Soon?

If your current mortgage is due to end before 30th June 2025, now is the perfect time to get in touch. This allows us to explore your remortgage options together.

We’ll review offers from your current lender and compare them with others to find the best deal for you. This review is completely free and comes with no obligation.

Remortgaging can also be a great time to make changes, such as:

- Adding or removing a name from the mortgage.

- Releasing equity for different purposes.

- Adjusting the length of your mortgage term.

- Reviewing your insurance policies to ensure they still suit your needs.

- Making any other changes you might have in mind.

✅ Mortgage Options Age 60+

Many customers over 60 find themselves unexpectedly needing a mortgage. The positive news is that there are many options available, whether you’re looking to buy a new home, pay off an existing mortgage, or release some money.

As an independent mortgage broker, we have access to a wide range of products and can recommend the one that best suits your needs.

Here are some common reasons why someone over 60 might need a mortgage:

- Paying off an existing mortgage.

- Buying a new property.

- Release equity for one reason or another.

- Short-term financing solutions.

- Consolidating debts.

- Boosting income or accessing a lump sum.

- Managing more complex financial situations.

👨💼 We Can Help With

- Age 50+ Mortgage Options.

- Age 60+ Mortgage Solutions including Equity Release.

- Bad Credit Deals.

- Bridging Loans.

- Secured Loans & Releasing Equity.

- Self-Employed Mortgages.

- All Purchase & Remortgage Deals.

- Life Insurance & Critical Illness Insurance.

- Pension Advice via a Referral Partner.

Malcolm Davidson

Managing Director @ UK Moneyman Ltd.

0333 412 2222